Export US tariff inquiry

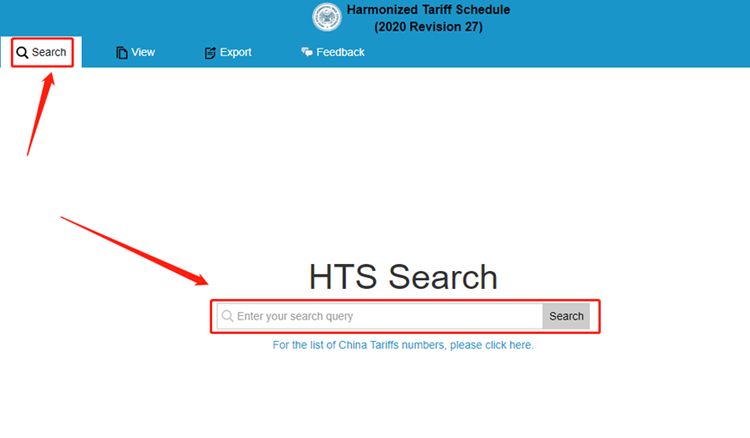

First of all, the US tariff is published by the US International Trade Commission (US International Trade Commission). If Amazon sellers want to know how much the tariff is for their goods exported to the US, they need to check the latest import tariff on the official website of the US Commission

-

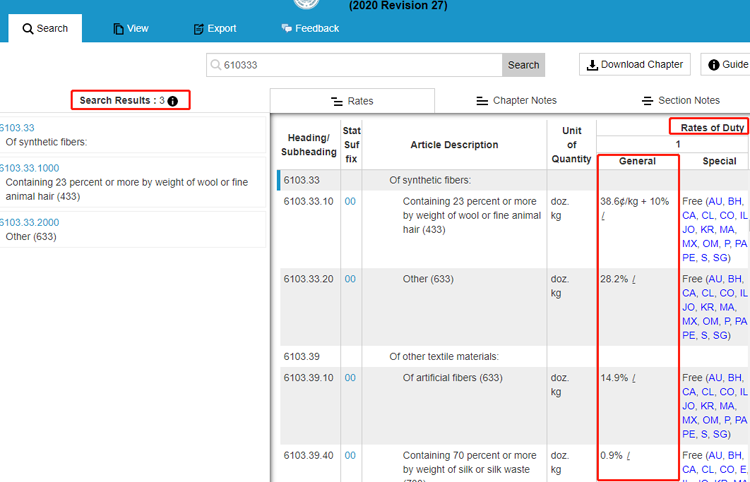

Then you get information about U.S. import taxes on all the clothing

It can be seen from the Search Results:3 in the left column that there are 3 search results, and the General in the column OF Rates OF Duty in the right column is the result of the corresponding import tariff of clothes to the United States. It can be seen that the tax on clothes is relatively high.

1 General refers to tariffs on most of the world's imports (including China's), and Special refers to tariffs on US imports from countries under FREE trade agreements (mostly free, but not from China).

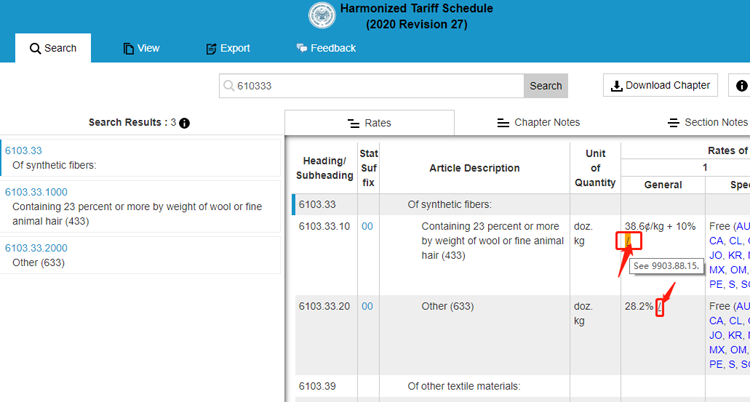

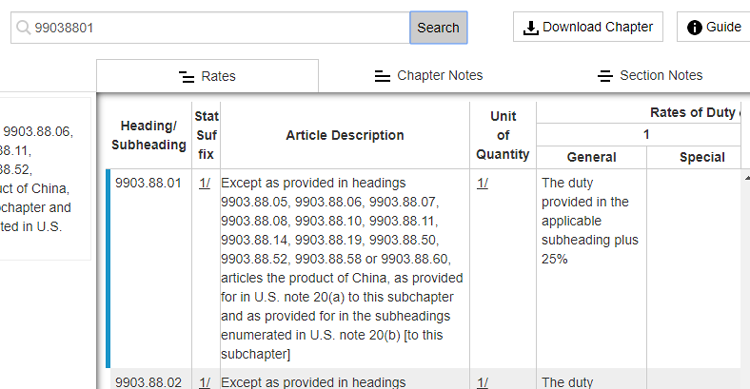

The first item means that if the composition of the cloth is more than 23% animal hair, such as wool, a surtax of $0.386 /kg will be charged, and then a tax of 10% will be charged. Look closely at the back of the slash, the mouse click past will appear a string of code, this means to add this tax, for example, 99038801 tax is 25%, for example, 99038815 tax is 7.5% (below).

Some new Amazon sellers will ask me if I don't know what the HS CODE of my product is. The HS CODE coding can query here: https://www.hsbianma.com, check out six is the international general before the customs CODE.

Before shipment, it is best to check the latest tariff changes of the United States. Maybe the goods that were normally exported last month have been charged 25% tariff in this month. It's easy to say that the goods have not been shipped, they are ready to go or they are already at sea, only to find out that there is a 25% tariff. The loss of money is a fact of life, but what to do with the goods is another matter. Continue to sell more losses, return to the motherland is difficult